Grant Overview

Federal loan guarantees up to $5.5 million helping American small businesses access capital through SBA-approved lenders – from microloans to commercial real estate financing

SBA small business loans are federally backed financing options guaranteed by the Small Business Administration, ranging from small to large amounts that can fund most business purposes, including long-term fixed assets and operating capital. Think of them as your business’s financial safety net when traditional banks say no. The New Bedford Economic Development Council operates as one of these qualified intermediaries, administering both SBA microloans and other funding programs that transform struggling entrepreneurs into thriving business owners across Massachusetts.

Here’s something most business owners miss. Many lenders look for a minimum credit score of 620, though those with lower scores may still qualify for startup funding. That single fact changes everything for entrepreneurs who assumed their less-than-perfect credit automatically disqualified them. The NBEDC’s lending programs take this reality into account, offering microloans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand, with the average microloan being about $13,000.

But wait. Lenders and loan programs have unique eligibility requirements, and in general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. The New Bedford Economic Development Council brings something different to the table – local expertise combined with federal backing. As an SBA intermediary lender, they manage multiple revolving loan funds including an EDA Funded RLF and a Brownfield RLF specifically for contaminated property cleanup.

Title: SBA Lending and Grant Programs

Donor: New Bedford Economic Development Council, U.S. Small Business Administration

Focus: small business loans, microloans, commercial real estate, gap financing, brownfield cleanup, SBA lending, business development, economic growth

Region: New Bedford, Bristol County, Massachusetts, United States

Eligibility:

– Small businesses and entrepreneurs in New Bedford

– Businesses creating or retaining Low-to-Moderate Income (LMI) jobs

– For commercial loans: businesses operating 2+ years

– For microloans: startups and existing businesses

– For real estate: businesses working with primary bank lender

– Must demonstrate ability to repay

– Cannot obtain sufficient credit elsewhere

Benefits:

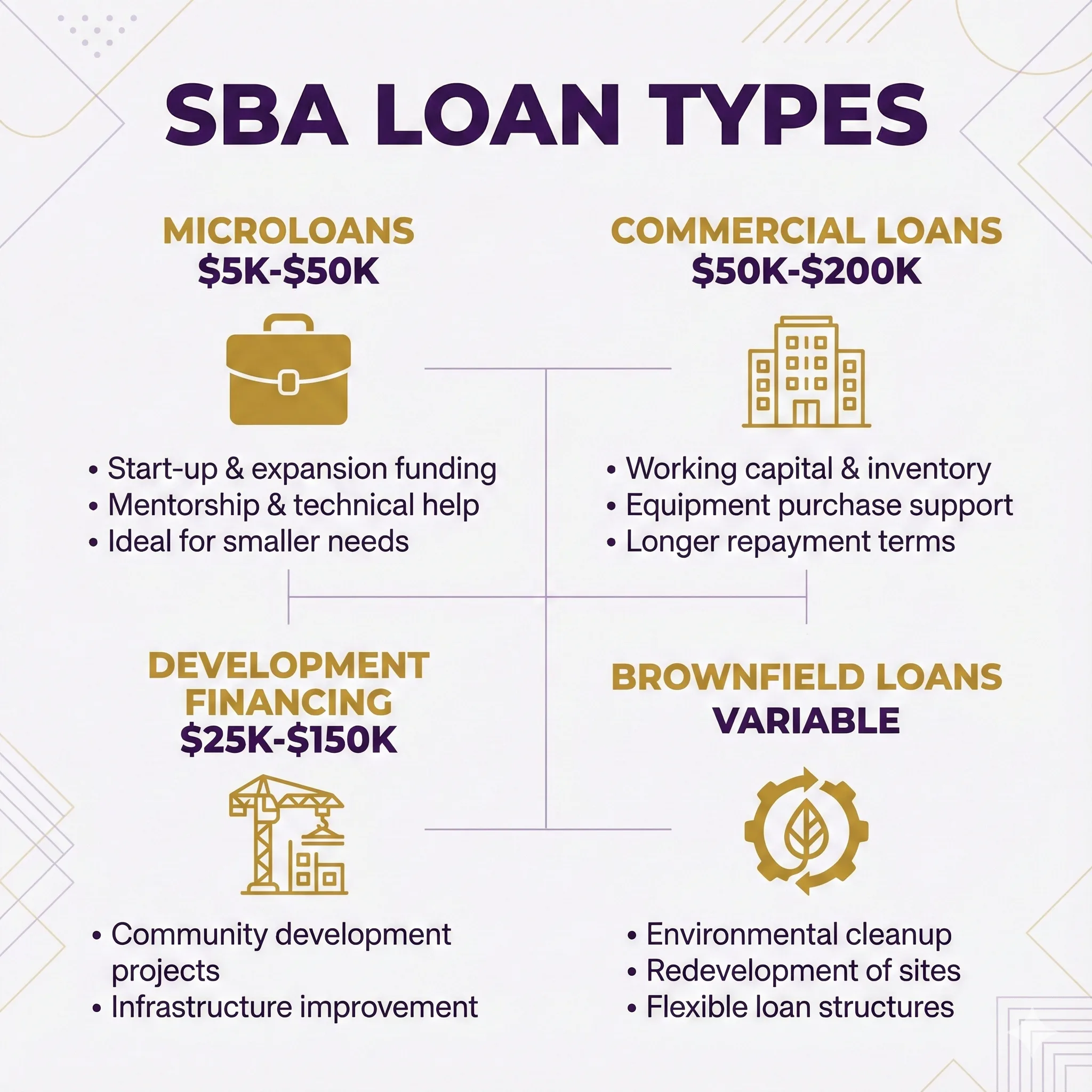

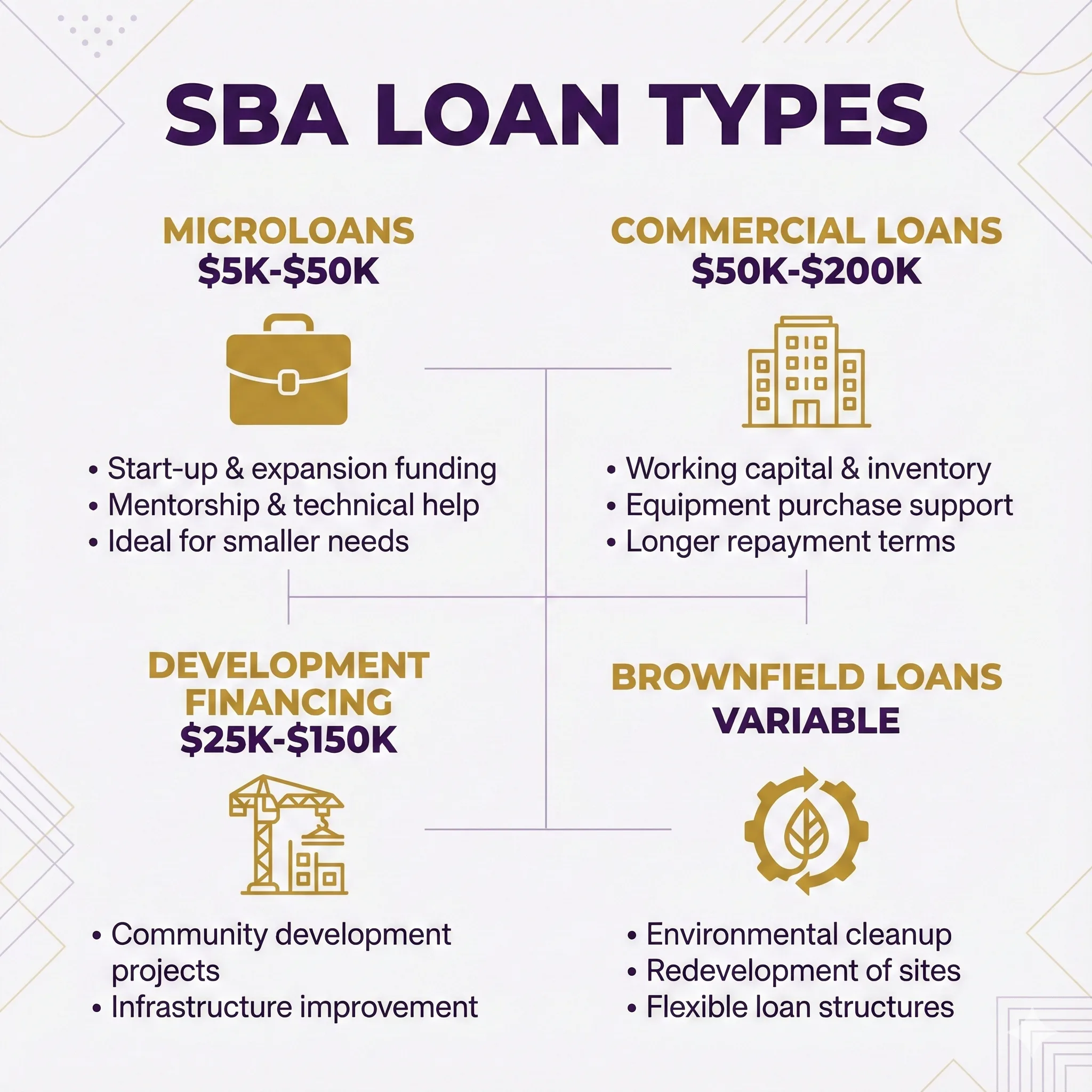

– Financial Award: Four distinct loan programs from $5,000 to $200,000

— SBA Microloan: $5,000-$50,000 for working capital, equipment, inventory

— Commercial Business Loan: $50,000-$200,000 for established businesses (2+ years)

— Development Gap Financing: $25,000-$150,000 for real estate acquisition/development

— Brownfield RLF: Variable amounts for environmental cleanup

– Technical Assistance: Business advising and management support included with SBA Microloans

– Flexible Terms: Up to 7 years for microloans, customized terms for other programs

– Local Decision-Making: Nine-member Loan Committee with understanding of regional business climate

– ACH Payment Processing: Convenient automated payment options

– Non-Discriminatory Access: Equal opportunity regardless of race, gender, age, or background

Deadline: Rolling

The NBEDC SBA small business loans program delivers what banks won’t: capital for emerging businesses through four targeted loan products ranging from $5,000 microloans to $200,000 commercial financing. As an approved SBA intermediary lender, the New Bedford Economic Development Council bridges the gap between ambitious entrepreneurs and the funding they need to grow without requiring perfect credit scores or two-year profit histories that traditional lenders demand.

Breaking Down the SBA Small Business Loans Landscape

Most entrepreneurs hear “SBA loan” and picture mountains of paperwork. Reality check? Regions Bank is a Preferred Lender Partner for SBA loans, handling the loan in-house from cradle to grave with no interaction with the SBA, thereby providing a smooth process for both you and your banker. The maximum loan size for microloans is $50,000 with an average of $13,000, while SBA loans offer several advantages including higher loan amounts ranging from $500 to $5.5 million depending on the program you apply for.

The New Bedford Economic Development Council operates differently from typical lenders. They’re boots on the ground in Massachusetts, understanding local market conditions. One LMI job must be created or retained for every $35,000 borrowed through their commercial business loan program. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose – even those with bad credit may qualify for startup funding, and the lender will provide you with a full list of eligibility requirements for your loan.

Who Really Qualifies for SBA Microloans?

Forget what you’ve heard about needing perfect financials. NBEDC’s microloan program targets the entrepreneurs banks typically ignore. These small-business loans are geared toward entrepreneurs who can’t get a traditional loan, such as borrowers with bad credit or new businesses, and are also a good option for businesses owned by women, minorities and veterans, as well as those in low-income communities. Street vendors, food trucks, home-based businesses – they all qualify.

Q: Can I get an SBA microloan with bad credit?

A: To qualify for a microloan from Ascendus, you’ll need at least six months of consistent revenue, a credit score of 575 or higher and no more than $3,000 in past-due debt.

Q: What’s the average SBA microloan amount?

A: About $13,000.

Q: How fast can I get approved?

A: Microloans can take as little as 14 days to be approved, whereas traditional loans backed by the SBA can take months.

Real Estate Development Through NBEDC Gap Financing

Picture this scenario. Your business found the perfect building but the bank won’t cover the full amount. That gap between what you have and what you need? That’s where NBEDC steps in with development gap financing ranging from $25,000 to $150,000. Collateral must have documented value sufficient to protect the interest of the lender and the Agency, with lenders discounting collateral consistent with sound loan-to-value policy with the discounted collateral value at least equal to the loan amount, and the lender must provide satisfactory justification of the discounts being used.

Unlike traditional second mortgages that carry crushing interest rates, NBEDC’s gap financing works in conjunction with your primary lender. They understand that small businesses acquiring owner-occupied properties face unique challenges. Manufacturing companies expanding their facilities. Restaurants purchasing their building instead of renting. Professional service firms establishing permanent headquarters. Each situation requires customized financing solutions that standard bank products can’t provide.

The Brownfield Revolving Loan Fund takes this concept further, offering below-market rates for businesses willing to tackle contaminated properties. New Bedford has plenty of former industrial sites perfect for redevelopment. Most 7(a) loans have a maximum loan amount of $5 million, however, 7(a) loans made under the SBA Express and Export Express delivery methods have maximum loan amounts of $500,000, with SBA’s maximum exposure at $3.75 million, though 7(a) International Trade loans may receive a maximum guaranty of 90% or $4.5 million.

Brownfield Cleanup: Turning Contaminated Land Into Business Assets

New Bedford’s industrial past left a complicated present. Properties contaminated with lead paint, asbestos, petroleum products, or hazardous materials sit vacant while businesses desperately need space. The Brownfield Revolving Loan Fund provides below-market rate loans to facilitate cleanup of these contaminated sites.

This program operates differently from the others. The City of New Bedford offers it, but NBEDC administers the lending component. Eligibility depends heavily on EPA regulations. Your site must have an actual release or substantial threat of release of hazardous substances. You can’t have caused the contamination. Phase I and II Site Assessments must be completed according to Massachusetts Department of Environmental Protection requirements.

Eligible cleanup activities include soil removal and consolidation, soil vapor barriers, engineered barriers, lead paint abatement and removal, asbestos removal, and other EPA-approved remediation work. Projects typically require six months for planning and community involvement activities, including a mandatory 30-day public comment period before cleanup begins.

All funded activities must comply with the Davis Bacon Act, meaning prevailing wage requirements apply to construction work. For questions about this program specifically, contact brownfields@newbedford-ma.gov rather than the general NBEDC lending team.

Q: Can startups apply for the Commercial Business Loan?

A: No. This program requires two years of operating history minimum.

Q: What counts as a low-to-moderate income job?

A: Positions filled by individuals earning below 80% of the area median income.

Q: Can I apply for multiple programs simultaneously?

A: Possibly, but you’ll need to demonstrate how each serves a distinct purpose without duplicating funding.

Q: What happens if my application is denied?

A: The Loan Committee provides feedback. You can reapply after addressing their concerns.

The Interest Rate Reality

Interest rates vary by program and borrower qualifications. SBA Microloans through NBEDC typically range between 8% and 13%, which aligns with national averages for the microloan program. Rates depend on the intermediary’s own cost of borrowing from SBA plus their administrative expenses and risk assessment.

Commercial Business Loan rates aren’t published because they’re negotiated based on project specifics, collateral, credit quality, and job creation impact. Development Gap Financing rates similarly depend on the overall project structure and primary lender terms.

Brownfield RLF loans offer below-market rates specifically to incentivize environmental cleanup. The exact rate depends on project scope, cleanup complexity, and redevelopment plans.

What you won’t find with any NBEDC program: predatory lending practices, balloon payments, or hidden fees that double the true cost of capital. The organization operates under strict SBA and EDA oversight, with non-discrimination policies covering race, color, religion, gender, gender expression, age, national origin, disability, marital status, sexual orientation, and military status.

Q: Can I refinance existing business debt with these loans?

A: Generally no for microloans. Other programs may consider refinancing as part of a larger growth strategy.

Q: What if I default?

A: NBEDC works with borrowers facing difficulties. Communication is critical. Default damages both your credit and future access to capital.

Q: Are there prepayment penalties?

A: Check your specific loan agreement. Many SBA loans allow prepayment without penalty.

Timeline and Key Application Milestones

Processing times vary dramatically between programs. SBA microloans through NBEDC can close within weeks. Commercial business loans take longer due to job creation requirements and additional documentation. Development gap financing moves at the pace of your primary lender since coordination between institutions is required.

Spring applications typically see faster processing as lenders have fresh annual budgets. December applications often face delays due to holiday schedules and year-end reporting requirements. Plan accordingly. Submit complete applications with all supporting documentation upfront to avoid back-and-forth delays that kill momentum.

Common Mistakes That Tank SBA Loan Applications

Nearly every lender will look at your credit score when they underwrite a loan – a credit score is a measure of how likely you are to pay back a loan, calculated over time as you apply for and pay back credit cards, car loans, home mortgages, and other debt. But credit scores tell only part of the story.

Business owners sink their applications by mixing personal and business expenses. Keep separate bank accounts. Document everything. That dinner with a potential client? Save the receipt and write notes about what you discussed. Lenders usually require at least two to three years of business operation, however, businesses that have been operational for six months can be eligible for some types of startup business loans.

Another killer? Unrealistic projections. Lenders see hundreds of applications claiming hockey-stick growth. Be conservative. Show steady, sustainable expansion rather than explosive growth that requires perfect execution. NBEDC’s loan committee includes local business leaders who understand market realities. They know a New Bedford restaurant won’t suddenly triple revenue without significant changes.

Beyond Traditional Lending: NBEDC’s Unique Approach

Traditional banks focus on credit scores and collateral. NBEDC looks at community impact. Creating jobs for low-income residents? That strengthens your application. Revitalizing a blighted property? Even better. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates – normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose.

Their lending staff provides technical assistance throughout the process. Not just filling out forms but understanding financial projections, identifying appropriate loan products, and connecting with other resources. Think of them as business advisors who happen to have lending authority.

The nine-member Loan Committee meets regularly to review applications. These aren’t distant bureaucrats but local leaders invested in New Bedford’s economic development. They understand seasonal businesses, fishing industry cycles, and the unique challenges of operating in a historic port city. Your application gets evaluated by people who know the territory.

Q: Do I need perfect credit for NBEDC loans?

A: No. Focus on demonstrating ability to repay and community benefit.

Q: Can startups qualify?

A: Yes, through the SBA Microloan program.

Q: What about businesses less than 2 years old?

A: Microloans only. Commercial loans require 2+ years operation.

Q: How much collateral do I need?

A: Varies by program. Microloans under $25,000 often require minimal collateral.

Similar to NBEDC’s approach, the Start.Pivot.Grow. Micro Grant offers quarterly $2,500 awards for established small businesses needing operational support.

Understanding Interest Rates and Fee Structures

Let’s talk real numbers. Interest rates for 7(a) loans are negotiated between the borrower and the lender but are subject to SBA maximums, which are pegged to the prime rate or an optional peg rate – interest rates may be fixed or variable, with SBA publishing the maximum fixed interest rates.

NBEDC’s rates compete favorably with traditional lenders, especially considering the added value of technical assistance and flexible underwriting. The Brownfield Revolving Loan Fund offers below-market rates recognizing the additional costs and risks of environmental remediation. Smart developers factor these savings into their project economics.

Lenders must pay an Upfront Fee for each loan guaranteed under the 7(a) program but are permitted to pass the cost on to the borrower, while the Lender’s Annual Service Fee based on the outstanding principal balance cannot be charged to the borrower, with SBA publishing fee amounts each fiscal year through an Information Notice.

Strategic Use of Multiple Funding Sources

Successful businesses rarely rely on single funding sources. Combine NBEDC programs strategically. Use a microloan for immediate working capital while preparing your commercial loan application. Leverage development gap financing alongside your primary mortgage. Each program serves specific purposes within your overall growth strategy.

Consider this real-world example. A food truck operator uses a $15,000 microloan for equipment upgrades and working capital. After establishing consistent revenue, they qualify for a $75,000 commercial loan to open a brick-and-mortar location. Finally, development gap financing helps them purchase the building. Three NBEDC programs supporting one business journey.

The Credibly Small Business Award provides $60,000 in grant funding that could complement NBEDC loan programs for qualified entrepreneurs.

Making ACH Payments and Managing Your NBEDC Loan

Once approved, success depends on flawless execution. NBEDC requires ACH payments ensuring timely processing. No forgotten checks. No mail delays. Automatic deductions keep you current and build positive payment history for future financing needs.

Set up ACH immediately upon loan closing. Don’t wait for the first payment due date. Email completed forms to Lending@NBEDC.org and confirm receipt. Keep copies of everything. Update banking information promptly if you change accounts. Simple administrative tasks that prevent major headaches.

For those unable to use ACH, mail payments to 1213 Purchase Street, New Bedford, MA 02740. But seriously, use ACH. It’s 2025. FSA’s Direct Operating loan interest rate applies to Operating Microloans while Direct Farm Ownership loan interest rate applies to Farm Ownership Microloans – the interest rate charged is always the lower rate in effect at the time of loan approval or loan closing for the type of loan wanted, with interest rates calculated monthly and posted on the 1st of each month.

Q: What happens if I miss a payment?

A: Contact NBEDC immediately. They prefer working with borrowers over initiating collection procedures.

Q: Can I pay off my loan early?

A: Generally yes, without prepayment penalties. Confirm with your specific loan terms.

Q: How do I access additional funds?

A: Establish positive payment history first. Then discuss expansion financing with lending staff.

Special Programs for Unique Situations

Not every business fits standard lending boxes. NBEDC recognizes this reality. The Brownfield program specifically helps businesses tackle environmental challenges that scare traditional lenders. Former gas stations, dry cleaners, and industrial sites become redevelopment opportunities rather than untouchable liabilities.

The purpose of the FSA Microloan Program is to meet the credit needs of young, beginning, socially disadvantaged, and veteran farmers through a simplified loan application process, appropriate for farmers serving local and regional food markets, with loans up to $50,000 allowing farmers to apply for both operating and ownership microloans for a combined maximum of $100,000.

Phase I and II environmental assessments must comply with Massachusetts Department of Environmental Protection requirements. Cleanup activities must follow federal and state regulations including Davis Bacon Act requirements for wages. It sounds complex because it is. But NBEDC guides borrowers through every step.

Urban agriculture initiatives particularly benefit from creative financing combinations. Rooftop gardens, hydroponic facilities, and community-supported agriculture projects access both traditional small business loans and specialized agricultural microloans. The Nehemiah Davis Greatness Grant offers another $2,500 quarterly opportunity for first-time founders who might later transition to NBEDC programs.

Building Your Business Credit While Borrowing

Microlenders tend to provide a pathway for small-business owners to receive the capital they need to grow while building their credit score, improving opportunity to obtain traditional debt financing in the future, with many microlenders guiding you through the loan process and offering advice to increase likelihood of approval and sustained success.

Each on-time payment to NBEDC strengthens your credit profile. Request payment history reports annually. Use them when applying for trade credit, equipment leases, or additional financing. Positive NBEDC loan performance opens doors with traditional banks who previously wouldn’t return your calls.

The key? Start small and grow strategically. Don’t request maximum amounts just because you qualify. Borrow what you need, deploy capital efficiently, and establish a track record. NBEDC values relationships over transactions. Successful borrowers often return for additional financing as their businesses expand.

Export and International Trade Considerations

New Bedford’s port status creates unique opportunities for international trade. Most U.S. banks view loans for exporters as risky, making it harder to get loans for day-to-day operations, advance orders with suppliers, and debt refinancing – that’s why SBA created programs to make it easier for U.S. small businesses to get export loans.

Businesses importing materials or exporting products face different cash flow challenges than domestic operations. Extended payment terms, currency fluctuations, and shipping delays require specialized financing solutions. NBEDC understands these complexities through decades of working with marine-related businesses.

Consider establishing banking relationships before you need export financing. Document international transactions meticulously. Build relationships with freight forwarders, customs brokers, and other trade professionals who can validate your business model to lenders. Microloan sizes vary based on program, starting at $500, with interest rates typically around 14.5%, available across Alabama, Arkansas, California, Florida, Georgia, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, New York, Oklahoma, South Carolina, Tennessee and Texas.

Technology and Digital Business Considerations

E-commerce changed everything about small business lending. Online businesses lack traditional collateral like real estate or equipment. Revenue comes through payment processors rather than cash registers. Customer acquisition happens through digital marketing rather than foot traffic.

NBEDC adapted to these realities. They evaluate online businesses based on gross merchandise value, customer acquisition costs, and lifetime customer value rather than just physical assets. Monthly recurring revenue from subscription services gets treated as predictably as rental income from real estate.

Digital businesses should prepare detailed analytics showing traffic sources, conversion rates, and customer retention metrics. Screenshot your payment processor dashboards. Document your ad spend and return on investment. Provide access to your books through QuickBooks Online or similar platforms. Transparency builds lender confidence.

Check Your Eligibility

Ready to explore your SBA small business loan options? Our eligibility tool helps you quickly determine which NBEDC programs match your business situation. Answer a few simple questions about your business type, years in operation, and funding needs to get personalized guidance on available loan programs.

23 More SBA Small Business Loans and Funding Opportunities

- Thrive – Breva Company Grant: $5,000 Quarterly Funding for Community-Focused Small Businesses: Perfect complement to SBA microloans for businesses creating measurable impact in underrepresented communities. This quarterly grant requires no repayment and focuses on job creation.

– Donor: Breva, Cadence Financial Group

– Focus: Community development, job creation

– Deadline: Quarterly (January 31, April 30, July 31, October 31)

- Honeycomb Credit $10,000 Breakthrough Grant for Business Expansion: Non-repayable funding for established businesses ready for their next major milestone like opening second locations or purchasing equipment – ideal alongside SBA 7(a) loans.

– Donor: Honeycomb Credit

– Focus: Business expansion, equipment purchase

– Deadline: Check current cycle

- Skip $10K Summer Grants for USA Entrepreneurs: Available to all US small business owners regardless of stage, this grant provides working capital that could help establish creditworthiness for future SBA loan applications.

– Donor: Skip

– Focus: Summer business growth initiatives

– Deadline: Ongoing

- Progressive $50,000 Vehicle Grant Plus Business Coaching: For businesses needing commercial vehicles, this substantial grant eliminates the need for vehicle financing through SBA loans, freeing capital for other growth investments.

– Donor: Progressive, Hello Alice

– Focus: Commercial vehicle acquisition

– Deadline: June 20, 2025

- EmpowHer Grants: Up to $25,000 for Female Entrepreneurs: Women-owned businesses can combine this grant with SBA programs designed for women entrepreneurs, leveraging both equity-free funding and low-interest loans.

– Donor: Boundless Futures Foundation

– Focus: Women-led social impact businesses

– Deadline: Quarterly (February 16 for Q1)

- McKinsey Fast Grants: $10,000 Plus Expert Mentorship for Chicago Businesses: Chicago-based entrepreneurs can access both capital and world-class consulting support that prepares them for larger SBA loan applications.

– Donor: McKinsey & Company, A4CB

– Focus: Underrepresented Chicago founders

– Deadline: Check current deadline

- Modest Needs Emergency Grants for Working Americans: When unexpected expenses threaten business stability, these emergency grants provide immediate relief while you pursue longer-term SBA financing solutions.

– Donor: Modest Needs Foundation

– Focus: Emergency financial assistance

– Deadline: Rolling

- Comprehensive Small Business Grants Category: Explore hundreds of grant opportunities specifically for small businesses that can supplement or replace traditional SBA loan financing.

– Donor: Various

– Focus: All small business types

– Deadline: Varies for each grant

- CriticalMass Program by MassCEC: Up to $1,000,000 for growth-stage climatetech startups ready for commercial deployment in Massachusetts, providing strategic partnerships with universities, municipalities, and corporations as deployment partners.

– Donor: Massachusetts Clean Energy Center

– Focus: Climatetech, commercial deployment, Massachusetts

– Deadline: Varies annually

- InnovateMass Grant: Up to $350,000 for Massachusetts cleantech startups at TRL 5-8 ready to bridge commercialization valley of death, with 50% cost share requirement and milestone-based payments.

– Donor: Massachusetts Clean Energy Center

– Focus: Cleantech, technology readiness, Massachusetts innovation

– Deadline: October 20, 2025

- Galaxy Grant for Women & Minority Entrepreneurs: $2,450 monthly funding for women and minority U.S. entrepreneurs with existing businesses or planning to start, featuring 5-10 minute application and access to 600,000+ member community.

– Donor: Hidden Star

– Focus: Women-owned businesses, minority-owned businesses, community access

– Deadline: Monthly

- Secretsos Small Business Grant: $2,500 quarterly business grants for underserved U.S. entrepreneurs (excluding Alaska, Florida, Hawaii, New York, Rhode Island) with complete spending flexibility and no business plan requirement.

– Donor: Secretsos Foundation

– Focus: Underserved entrepreneurs, flexible spending, quarterly grants

– Deadline: Quarterly (March 31, June 30, September 30, December 31)

- Idea Cafe Small Business Grant: $1,000 funding specifically for women entrepreneurs in the United States who either currently own a business or are planning to launch new ventures, featuring a streamlined application process without complex business plan requirements.

– Donor: Idea Cafe

– Focus: Women entrepreneurs, small business funding, accessible application

– Deadline: Varies annually

- She’s Connected by AT&T: National contest offering $50,000 grand prize plus major media exposure and mentorship to U.S. small business owner, with four runners-up receiving $5,000 each, all focused on businesses that build community connections.

– Donor: AT&T Services

– Focus: Community development, women-led business, marketing exposure

– Deadline: Varies annually

- ZenBusiness Small Business Grant Program: Quarterly $5,000 grants for U.S. small businesses that used ZenBusiness formation services within the last 3-6 months. Unlike loans, this funding requires no repayment.

– Donor: ZenBusiness

– Focus: Small business growth, entrepreneurship, community impact

– Deadline: Quarterly (January 1, April 1, July 1, October 1)

- Start.Pivot.Grow. Micro Grant: $2,500 quarterly non-dilutive funding designed for established small businesses in the United States, complemented by Digital Business Growth Planner and Prep My Loan Planner tools that help recipients maximize impact and develop sustainable business practices.

– Donor: Integrality, The UPS Foundation, The Dallas College Foundation, Wells Fargo

– Focus: Small business support, operational expenses, growth capital, financial stability

– Deadline: Rolling quarterly

- Massachusetts Business Funding Opportunities: Local and state programs available to Massachusetts businesses that often work in conjunction with SBA lending programs.

– Donor: Multiple Massachusetts organizations

– Focus: Massachusetts-based businesses

– Deadline: Varies for each program

- National USA Business Grants and Loans Database: Access the complete collection of federal funding opportunities including specialized SBA programs for veterans, minorities, and rural businesses.

– Donor: Federal agencies and partners

– Focus: Nationwide business support

– Deadline: Varies for each opportunity

- 2025 USA Funding-Ready Grant: $1,500 for Business Preparation: Strategic preparation funding that helps entrepreneurs develop the documentation and business plans required for successful SBA loan applications.

– Donor: Grantaura

– Focus: Funding readiness preparation

– Deadline: June 15, 2025

- Minority Entrepreneur-Focused Grant Programs: Early-stage funding options for minority entrepreneurs who need initial capital before qualifying for traditional SBA small business loans.

– Donor: Multiple sources

– Focus: Startup and early-stage ventures

– Deadline: Varies by program

- Ford Foundation JustFilms: Up to $100,000 for Documentary Filmmakers: Creative businesses and media companies can access substantial grant funding for projects addressing social justice, reducing reliance on traditional business loans.

– Donor: Ford Foundation

– Focus: Social justice documentary films

– Deadline: April 2025

- Nonprofit Grant Opportunities: While most SBA programs exclude nonprofits, these dedicated grant programs provide alternative funding for qualifying not-for-profit childcare centers and social enterprises.

– Donor: Various foundations

– Focus: Nonprofit organizations

– Deadline: Varies for each grant

- Global Arts Fund for LGBTQI Artists and Organizations: Arts-based businesses and creative entrepreneurs can access flexible funding that complements SBA microloans for equipment and working capital needs.

– Donor: Astraea Lesbian Foundation

– Focus: LGBTQI art for social change

– Deadline: Nomination-based

Beyond individual grant opportunities, Grantaura’s comprehensive database contains thousands of funding options updated daily. Smart entrepreneurs combine grants with SBA loans, creating layered financing strategies that minimize debt while maximizing growth potential. The platform’s free resources help identify opportunities matching your specific business profile, industry, and location.

Terms

- SBA Guarantee: The Small Business Administration doesn’t lend money directly but guarantees a portion of the loan to reduce lender risk. For most 7(a) loan programs, SBA guarantees up to 85 percent of loans of $150,000 or less, and up to 75 percent of loans above $150,000, with SBA providing a 50% guaranty on SBA Express loans and 90% guaranty for Export Express, Export Working Capital Program, and International Trade loans.

- Preferred Lender: Banks with special SBA designation allowing faster processing and delegated authority. These lenders handle everything in-house without sending paperwork to SBA offices, cutting weeks off approval times.

- Microloan Intermediary: Nonprofit, community-based organizations experienced in lending and business management assistance that receive funds from SBA to issue microloans under certain conditions between SBA and intermediaries, and certain conditions between intermediaries and borrowers.

- LMI (Low-to-Moderate Income) Jobs: Employment positions paying wages accessible to workers from economically disadvantaged backgrounds. NBEDC requires one LMI job per $35,000 borrowed through commercial loans.

- Gap Financing: Secondary financing covering the difference between primary bank loans and total project costs. NBEDC’s development gap financing specifically helps small businesses acquire owner-occupied commercial real estate.

- Brownfield Site: Properties with actual or perceived environmental contamination requiring cleanup before redevelopment. These sites often sell below market value but require specialized financing for remediation.

- 7(a) Loan Program: SBA’s primary business loan program providing loan guaranties to lenders that allow them to provide financial help for small businesses with special requirements. The most versatile and widely used SBA loan type.

- 504 Loan Program: Long-term, fixed-rate financing available through mission-oriented, community-based SBA Certified Development Companies. Specifically for real estate and equipment purchases.

- Credit Elsewhere Test: SBA requirement that borrowers cannot obtain financing on reasonable terms from non-government sources. You must be turned down by traditional lenders or offered unreasonable terms.

- Personal Guarantee: An account requires personal guarantees from any owner with 25% or more ownership in the applicant business, with a minimum combined aggregate of 51% ownership. Owners become personally liable for loan repayment.

- Debt Service Coverage Ratio (DSCR): Calculation showing whether business cash flow adequately covers loan payments. Most SBA lenders require minimum 1.25 DSCR meaning $1.25 in cash flow for every $1 in debt payment.

- Character Lending: Lending decisions based on borrower reputation, community standing, and business relationships rather than just financial metrics. NBEDC considers character alongside traditional underwriting criteria.

- Working Capital: Funds for day-to-day operations including inventory, payroll, rent, and utilities. SBA microloans commonly provide working capital for businesses with seasonal cash flow fluctuations.

- Collateral Discount: Reduction in asset value for lending purposes. Lenders discount collateral consistent with sound loan-to-value policy with the discounted collateral value at least equal to the loan amount. Equipment might be valued at 50% of purchase price.

- Prime Rate: Base interest rate used for calculating SBA loan rates. Interest rates for 7(a) loans are negotiated between borrower and lender but subject to SBA maximums pegged to prime rate. Variable rate loans adjust with prime rate changes.

- ACH Payment: Automated Clearing House electronic payment system. NBEDC requires ACH for loan payments ensuring timely processing without mailing delays or lost checks.

- Revolving Loan Fund (RLF): Pool of capital used for lending that gets replenished as borrowers repay loans. NBEDC manages multiple RLFs including EDA and Brownfield funds with different eligibility criteria.

- Size Standards: SBA definitions determining small business eligibility based on average annual receipts or number of employees. Standards vary by industry with manufacturing allowing up to 500 employees while retail typically caps at $8 million annual revenue.

- Technical Assistance: Business counseling and training provided alongside loans. Microloans are available through certain nonprofit, community-based organizations that are experienced in lending and business management assistance. NBEDC includes technical assistance with all loan programs.

- Loan-to-Value Ratio (LTV): Loan amount divided by collateral value. Conservative lenders might require 50% LTV meaning $50,000 loan secured by $100,000 asset. Higher LTVs indicate greater lender risk tolerance.

Author

When I started working with small businesses seeking SBA financing, one pattern kept emerging. Entrepreneurs would arrive with brilliant ideas but no understanding of how government-backed lending actually works. The New Bedford Economic Development Council programs changed my perspective on what community-focused lending could achieve. Unlike big banks treating loan applications as numbers on spreadsheets, NBEDC evaluates businesses within their local context. A fishing supply company facing seasonal fluctuations gets different consideration than a year-round manufacturer. That human touch makes all the difference when your business doesn’t fit conventional lending boxes.

Through Grantaura, I’ve seen how combining grants with SBA small business loans creates sustainable growth trajectories rather than debt burdens. Sometimes the best financing strategy isn’t choosing between options but strategically layering multiple funding sources. Every business journey starts with understanding what’s actually available beyond the headlines about million-dollar venture capital rounds that most small businesses will never see.

About Imran · Book a Free Consultation